New Progressive Mansion Tax

This new law applied to all NYC contracts that were signed on or after April 1, 2019 and that close on or after July 1, 2019.

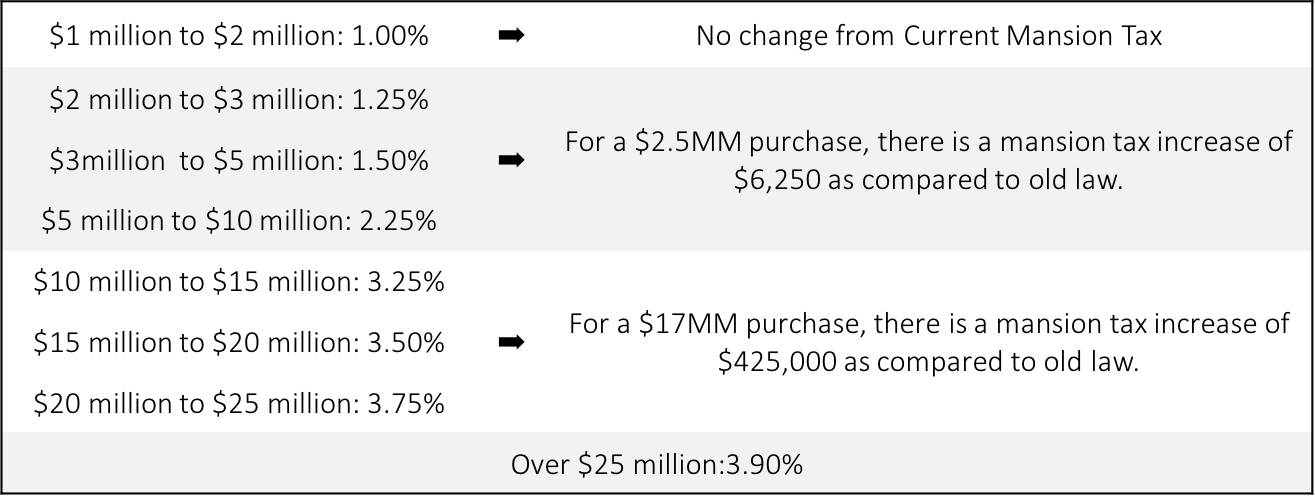

Effective April 1, 2019, as part of the new state budget there will now be 8 tiers, each with a mansion tax rate that increases as purchase prices increase.

Since its enactment in 1989, New York State Mansion Tax has held firm at 1%.

Purchase Price Range

The New Progressive NYS Transfer Tax

In addition to an overhaul of the NYS Mansion Tax, the NYS Transfer Tax will be also be changing, effective April 1, 2019.

For Residential Purchases greater than $3 million, the NYS Transfer Tax increases from its current rate of 0.4% to 0.65%.

This new rate also applies for commercial purchases greater than $2 million.

Why is this new tax rule called “progressive”?

Additional Changes in the New State Budget

The NYS top income tax rate (for those who earn over $1 million/year) will not be increased for at least the next 5 years.

The temporary property tax cap (limiting property tax increases to no more than 2% from year to year) in now permanent.

The proceeds from these new taxes are earmarked for the MTA for subway repairs and upgrades.